The 1953 Revaluation of the Gold Certificate

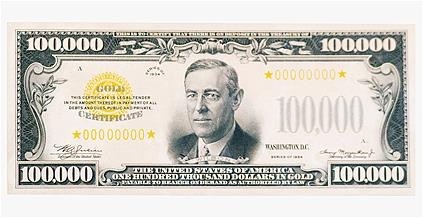

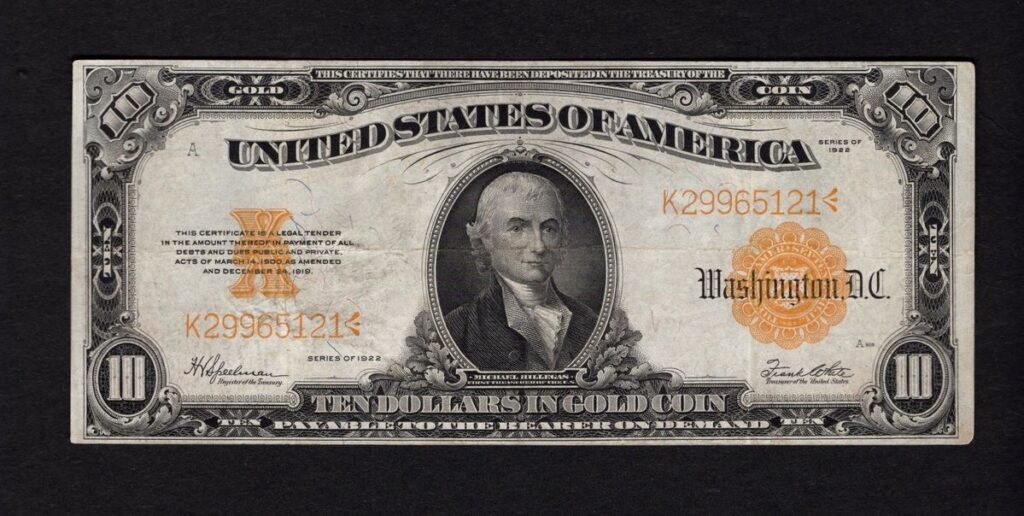

In 1953, the Federal Reserve, also known as the Fed, made a significant move by revaluing its gold certificates. The gold certificate, a paper currency issued by the United States between 1863 and 1933, was backed by gold. The revaluation was a strategic decision that had a profound impact on the economy.

The Fed’s decision to revalue the gold certificates was driven by the need to stabilize the economy and maintain a steady gold standard. The revaluation increased the value of the gold certificates held by the Fed, which in turn increased the monetary base. This move was instrumental in stabilizing the economy during a period of economic uncertainty.

The Impact of the Revaluation

The revaluation of the gold certificate had both immediate and long-term effects on the economy. Immediately, it increased the value of the gold reserves held by the Fed, providing a much-needed boost to the economy. In the long term, it helped to stabilize the economy and maintain a steady gold standard, which is crucial for economic stability.

The Relevance of the Gold Certificate Today

The revaluation of the gold certificate in 1953 provides valuable lessons for today’s economic landscape. It shows the importance of strategic decision-making in monetary policy and the role of central banks in stabilizing the economy.

In today’s economy, the certificate could serve as a hedge against inflation. As the value of gold tends to rise during periods of inflation, holding gold certificates could provide a measure of protection against the eroding value of currency.

Pros and Cons

Like any financial instrument, the gold certificate has its pros and cons. On the positive side, it provides a hedge against inflation and can serve as a stable store of value. It also offers a tangible asset that is universally recognized and valued.

On the downside, the value of the certificate is tied to the price of gold, which can be volatile. Additionally, while the gold certificate can serve as a hedge against inflation, it may not provide the same level of return as other investments.

Conclusion

The revaluation of the gold certificate by the Fed in 1953 was a significant event in economic history. It provides valuable lessons for today’s economy, highlighting the importance of strategic decision-making in monetary policy. While the certificate has its pros and cons, it remains a valuable financial instrument that can provide a hedge against inflation and serve as a stable store of value.