In the realm of economics, finance, and business, standard deviations serve as a crucial tool. They measure variability or volatility in a set of data, illuminating the consistency of data points around the mean.

Understanding Standard Deviations

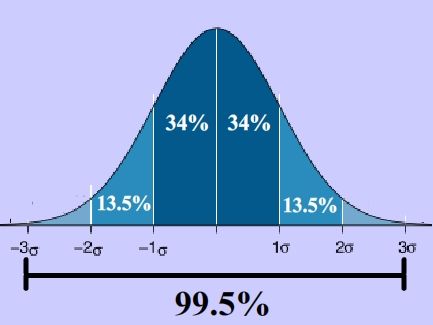

Deviations quantify the amount of variation in a dataset. A low standard deviation indicates that data points cluster closely around the mean, suggesting low volatility. Conversely, a high standard deviation denotes high variability with data points dispersed over a wider range.

Behind The Mechanics

Calculating the standard deviation involves several steps. First, find the mean or average of the dataset. Next, subtract the mean from each data point, yielding the deviation. Square each deviation, then calculate the mean of these squared deviations. The deviation is the square root of this mean.

In Action

In finance, standard deviations are used to measure the volatility of assets like stocks, bonds, and mutual funds. For example, a stock with a high deviation has high volatility, indicating a higher degree of risk but also potential for higher returns.

Pros and Cons

Standard deviations are a valuable tool, but they also come with limitations.

Pros:

- Risk Assessment: Deviations aid in evaluating the risk of financial instruments, helping investors make informed decisions.

- Data Comparison: They allow comparison between different data sets, offering a clear perspective on variability.

Cons:

- Sensitive to Outliers: Deviations can be greatly affected by outliers or extreme values, leading to a skewed measure of variability.

- Assumes Normal Distribution: They assume data is normally distributed, which is not always the case, limiting their applicability in certain scenarios.

Uses In Everyday Finance

Standard deviations play an integral role in various financial contexts:

- Investment Risk: In portfolio management, a Standard deviation is measure an investment’s risk. A portfolio with a higher standard deviation is considered riskier.

- Pricing Models: Financial models like the Black-Scholes model for option pricing utilize standard deviations.

The Power of Standard Deviations

Understanding standard deviations is an essential skill for future economists, financiers, and business leaders. They serve as a universal measure of variability, offering insights into the risk and volatility inherent in financial decisions. By mastering the concept of deviations, we can leverage data more effectively, make informed decisions, and minimize risk.